![]()

Guess the engineer! Image credit: Tech In Asia.

Do you know what’s the highest-paid engineering job in Southeast Asia?

It’s not software engineering. It’s not app development. And no, it’s not data analytics.

DevOps and cloud management jobs rake in the highest mean salary out of all engineering jobs at US$4,040, according to Tech In Asia’s 2,760 published technical jobs data in the first half of 2017.

However, these job opportunities received the least number of applicants. It’s an overlooked area for tech job seekers and one for which employers are eager to hire.

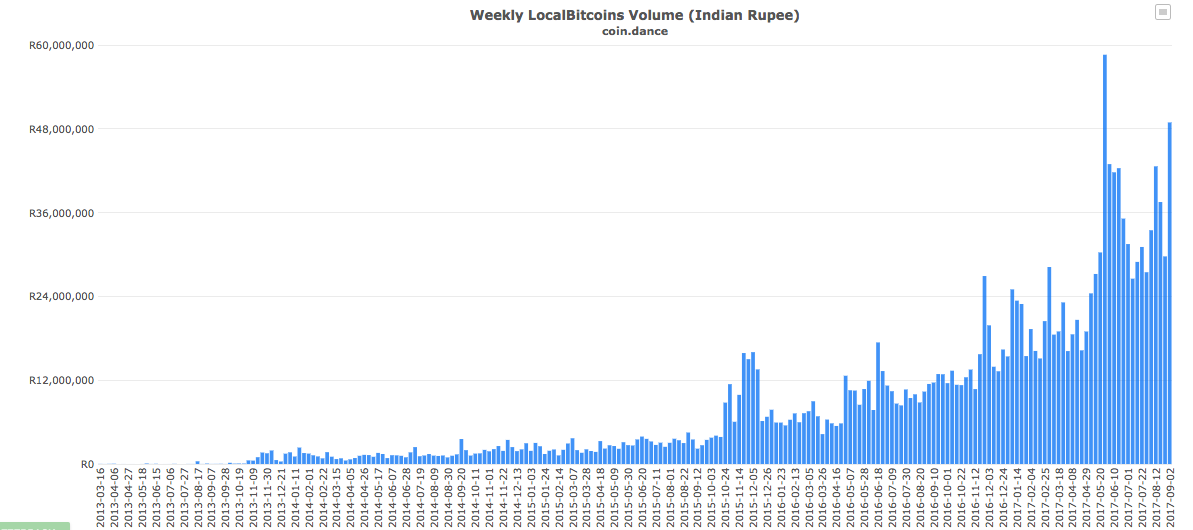

![]()

Image credit: Tech In Asia.

The overlooked cousin in Singapore

A cloud architect isn’t someone who solely writes code – he or she is responsible for cloud computing strategy. This includes running applications related to the business, customer-facing cloud-based applications, and managing and monitoring the cloud.

A good architect can be hard to find. “It’s nearly impossible to hire anyone to do cloud in Singapore,” says Gerald Goh, lead developer of fintech startup Nickel.to.

“It’s hard enough to hire for backend, and it’s even more problematic to hire for infrastructure. Most people will get senior people to do cloud management. But even then, not many would have dealt with cloud,” Goh says.

But companies will continue to migrate to the cloud. Forecasts for spending growth in the public and private cloud markets are close to 20 percent year-on-year globally. Cloud computing spending itself is growing at nearly five times the rate of traditional IT spending, according to recruitment agency Hays.

Amazon Web Service (AWS) is ahead of the cloud services pack in Asia Pacific (excluding Japan), followed by Microsoft and Alibaba, according to research from IDC. Fun fact: Singapore’s public data is hosted on Amazon Web Services.

Correspondingly, the number of job postings for AWS roles in Singapore has increased by 69.8 percent from April 2015 to 2017, according to jobs search engine Indeed.

Similar to how prospective coders can attend boot camps, instructor-led AWS authorized cloud-related courses are available to prepare fresh and mid-career professionals to make cloud their niche. Professional development is endorsed and funded by the Singapore government through the Critical Infocomm Technology Resource Programme Plus (CITREP+).

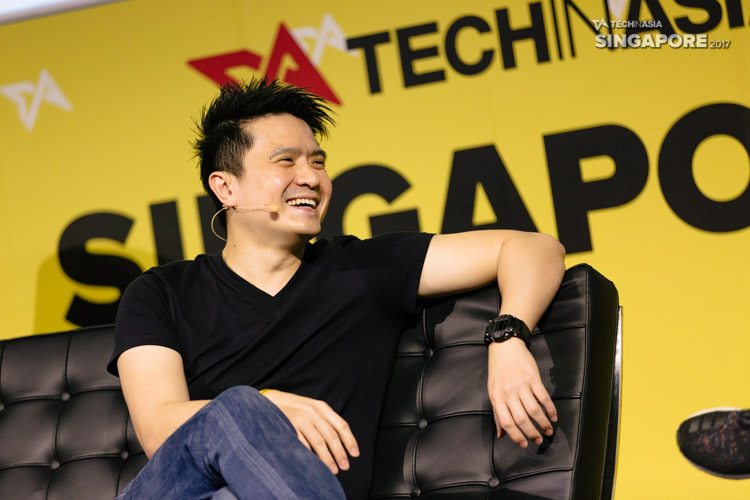

![]()

Image credit: Pixabay.

Not just picking up coding or cloud knowledge

Aaron Lee, CTO of healthcare-startup Jaga-me, says that AWS provides him a standardized way to assess tech talents.

AWS provides a standardized way to assess tech talents.

The Singapore-based startup allows people to book medical appointments on the go, send appointment information to healthcare providers, and track healthcare professionals.

He rattles off a list of Amazon services vital to their business, including the Lambda, EC2, and relational database services.

“Say five years ago, if I were to interview someone, I would be guessing if he knows how to do it based on his and my technologies. Right now, I can bypass a lot of that just by asking for their AWS experience,” Lee says.

Surprisingly, having certificates in PHP or Python doesn’t matter as much to Lee.

“You can pick up skills, but being a cloud services architect is about approaching a problem and creating a solution,” he says.

Cloud architects need to have the right framework and thought process for problem-solving. They need to know what cloud services to pool to create a solution.

“For instance, I could ask the candidate to give me a real-time stream of jobs. In the past, I would have to guess based on the technologies I am using. Now, if I want the candidate to do it, I just need to ask if he or she knows AWS Kinesis Firehost and Dynamo DB,” he says.

I just need to ask if he or she knows AWS Kinesis Firehost and Dynamo DB.

Goh says that being a cloud architect is nearly the opposite of being a developer. “As a dev you want to develop features as fast as possible. A cloud architect needs to keep the system very stable,” Goh says.

“I have automated scripts – my servers need to be specifically configured all the time.” There’s no room for typing errors or mistakes, Goh says.

Employers in Singapore will eventually expect a certain level of AWS expertise as the market continues to mature and the technology continues to evolve.

“Employers will prefer experience, a confident understanding of cloud platforms, and the ability to effectively leverage cloud solutions and services: even a minimum of an associate-level AWS Certification,” says Trent Rosenthal, CEO of Bespoke Training Services, the AWS authorized training partner for Singapore, Australia and New Zealand.

How to begin working with the cloud

Starting out in IT infrastructure is the hardest part.

Lee recommends just diving in. “It’s nearly no cost to run an AWS service like Lambda,” Lee says. He says that his intern picked up nine different services within three months.

“I believe most people need a direction, like a project, to learn new skills,” says Goh. “Start off easy, build up a basic WordPress site, add a load balancer, and so on.”

Goh recommends that beginners start with a virtual machine first, such as Linux. “Linux will help you get into infrastructure as most of the servers are Linux-based. It’s open source so it’s cost-saving,” Goh says.

“If you come from an infrastructure background as a system administrator, it’s time for you to start building your understanding of scripting languages,” says Adam Edwards, business director of Hays in Singapore.

For example, Edwards recommends that candidates should know more about automation tools such as Ansible, R, SQL, and Python, and their applications in an AWS environment.

“The cloud is a regularly and rapidly changing environment, especially the AWS platform where updates and new tools and services are released every week,” Rosenthal says. Combining self-directed learning, on the job practice, and government-endorsed courses can help people become cloud specialists. He recommends the Architecting on AWS course, which trains cloud architects to use the AWS Well-Architected Framework to improve architectures, increase infrastructure and applications performance, and reduce costs.

It’s time for tech job seekers to evolve beyond coding. The opportunity for both training and jobs exist for those IT professionals that are ready and willing to step into the cloud

Bespoke Training is the only AWS-authorized training partner in Singapore (and ANZ) and delivers AWS training opportunities in 9 cities across Singapore, Australia, and New Zealand. All courses are led by highly experienced, authorized AWS instructors and offer a combination of training, resources, and hands-on experience.![]()

The Critical Infocomm Technology Resource Programme Plus (CITREP+) supports professionals who are Singaporean citizens or permanent residents. The current CITREP+ endorsed program is AWS Certified Solutions Architect Associate. Learn more about available funding and register here.

This post Who’s the highest-paid engineer? It’s the overlooked cloud architect appeared first on Tech in Asia.

![]()